7 Smart Gift Shop Financing Options to Launch Your Business

Embarking on the journey of opening a gift shop is exciting, but let’s face it – securing the necessary financing can be daunting. If you’re wondering how to fund your retail dreams, you’re in the right place. We’ll explore gift shop financing options that can help you stock those shelves and open your doors with confidence.

Why Gift Shops Can Be a Lucrative Venture

Before we dive into financing, let’s talk about why gift shops can be a great business opportunity:

- Year-round demand: People always need gifts for various occasions.

- High markup potential: Unique items often command premium prices.

- Repeat customers: Gift-givers often return for future purchases.

- Seasonal booms: Holidays can significantly boost sales.

- Community connection: Local gift shops often become neighborhood staples.

Table of Contents

Gift Shop Financing Options

Now, let’s unwrap the financing options available to aspiring gift shop owners. Discover effective gift shop financing options to turn your retail dreams into reality. Learn about small business loans, startup funding, and crafting a winning business plan for your new gift store.

1. Traditional Small Business Loans

Small business loans are a go-to option for many retail startups, including gift shops. Here’s what you need to know:

- Offered by banks and credit unions

- Typically require a solid credit score and business plan

- Can provide substantial funding for inventory, rent, and other startup costs

- Interest rates vary, so shop around for the best terms

Pro tip: Build a relationship with your local bank before applying. They might be more willing to work with you if they know you personally.

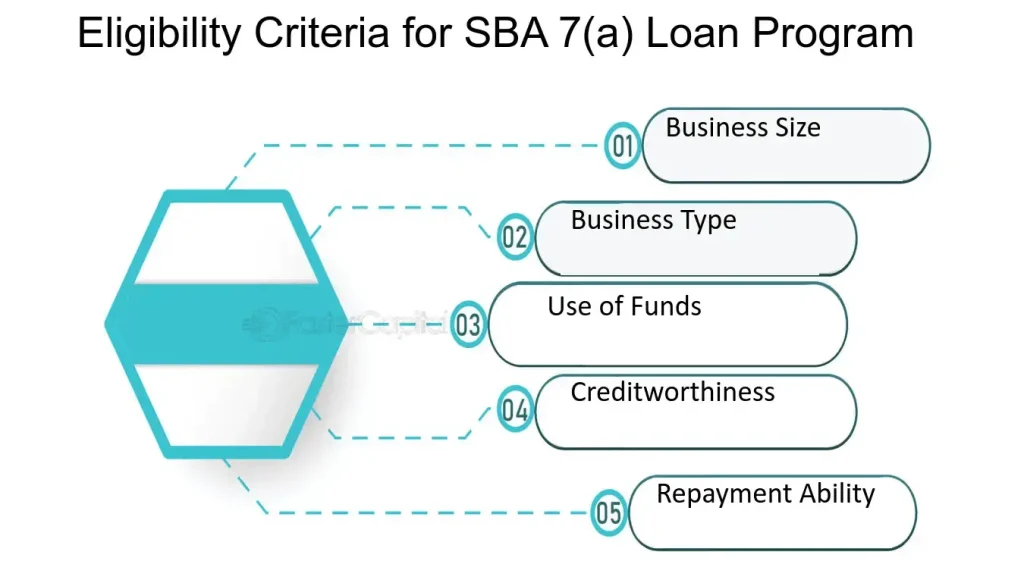

2. SBA Loans

The Small Business Administration (SBA) offers loan programs that can be a lifeline for new gift shop owners:

- Lower down payments and flexible terms compared to traditional loans

- SBA guarantees a portion of the loan, reducing the lender’s risk

- Options include the popular 7(a) loan program and microloans for smaller amounts

Remember: While SBA loans have great terms, the application process can be lengthy. Start early!

3. Crowdfunding: Letting Your Community Invest in Your Vision

Platforms like Kickstarter or Indiegogo allow you to pitch your gift shop idea to the masses:

- Can generate buzz and a customer base before you even open

- Offers rewards to backers, like early access or exclusive products

- Success often depends on your marketing skills and network

Insider tip: Create a compelling video showcasing your gift shop concept to increase your chances of crowdfunding success.

4. Angel Investors: Finding Your Retail Guardian Angel

Angel investors are individuals who provide capital for startups in exchange for equity:

- Can offer significant funding and valuable business expertise

- Often interested in unique or innovative retail concepts

- Typically expect a high return on investment

To attract angel investors:

- Develop a rock-solid business plan

- Create a compelling pitch deck

- Network at local business events or through online platforms

5. Personal Savings and Assets: Investing in Yourself

Using your own resources shows lenders and investors that you’re committed:

- Demonstrates your belief in the business

- Can include savings, retirement accounts, or home equity

- Often necessary to secure additional financing

Caution: Be careful not to overextend yourself financially. Only invest what you can afford to lose.

6. Friends and Family Funding: Keeping It in the Circle

Borrowing from loved ones can be an option, but proceed with caution:

- Can offer more flexible terms than traditional loans

- Potentially strains personal relationships if the business struggles

- Always formalize the agreement in writing

Pro tip: Treat loans from friends and family as professionally as you would any other financing option.

7. Vendor Financing: Stocking Shelves on Credit

Some wholesalers offer credit terms to help you stock your initial inventory:

- Allows you to pay for products after they’ve been sold

- Can help with cash flow in the early stages

- Build relationships with vendors for better terms over time

Remember: Carefully manage your inventory to ensure you can meet payment terms.

Crafting a Winning Business Plan for Your Gift Shop

Regardless of which financing option you choose, a solid gift shop business plan is crucial. Here’s what to include:

- Executive Summary: A snapshot of your gift shop concept

- Market Analysis: Research on your target customers and competition

- Product Line: Details on the types of gifts you’ll sell

- Marketing Strategy: How you’ll attract and retain customers

- Financial Projections: Realistic estimates of costs, revenue, and profitability

- Management Team: Information on key personnel and their expertise

Insider tip: Consider hiring a professional business plan writer if you’re not confident in your writing skills.

Securing Retail Space: Location, Location, Location

Once you’ve secured financing, finding the right location is crucial. Consider:

- Foot traffic patterns

- Nearby complementary businesses

- Lease terms and costs

- Potential for future expansion

Remember: A great location can significantly impact your gift shop’s success, so choose wisely!

Navigating the Challenges of Retail Financing

Securing financing for a gift shop can be challenging. Common hurdles include:

- Lack of collateral

- Limited business credit history

- Competitive retail market

To overcome these:

- Build your personal credit score

- Start small and grow gradually

- Consider a pop-up shop to test the market before committing to a permanent location

Conclusion

Securing financing for your new gift shop may seem daunting, but with persistence and the right approach, it’s entirely achievable. Whether you opt for traditional loans, crowdfunding, or a combination of strategies, remember that your passion and solid gift shop business plan are your greatest assets.

Now, armed with these gift shop financing options, you’re ready to turn your retail dreams into a wrapped and ribboned reality!

We’d love to hear about your plans for opening a gift shop. What unique angle are you considering? Have you encountered any surprising challenges in securing financing? Share your experiences in the comments below!